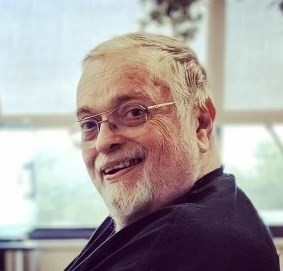

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

As your college student heads back to campus this fall with a computer, cell phone, tablet, headset and other valuable items in tow, perhaps you have already considered what might happen if these items were vandalized, damaged by fire or perhaps even stolen. Would your homeowners policy cover such a loss, allowing replacement of your student's possessions while away at college? In fact, you can protect your student's valuables against these kinds of losses through the right insurance. If you plan ahead, you can avoid the risks of being caught unaware about your student's insurance coverage.

As your college student heads back to campus this fall with a computer, cell phone, tablet, headset and other valuable items in tow, perhaps you have already considered what might happen if these items were vandalized, damaged by fire or perhaps even stolen. Would your homeowners policy cover such a loss, allowing replacement of your student's possessions while away at college? In fact, you can protect your student's valuables against these kinds of losses through the right insurance. If you plan ahead, you can avoid the risks of being caught unaware about your student's insurance coverage.

Do You Need Additional Insurance Coverage?

A little advanced planning can often save the day. You'll want to sit down with your child and list everything that will be moved to college. This will then allow you to put a value on each item. When you have that information documented, then contact your insurance agent to confirm your homeowners policy coverage including any coverage limitations. When you have determined the maximum coverage limit available for your student, then compare it to the total value of your child's belongings. If the total value exceeds the maximum coverage, you’ll want to know it now so that you can increase your coverage before there is a need to file a claim.

On Campus or Off? Homeowners or Renters Insurance?

Your agent will ask whether your child will be living in an off-campus apartment or on campus. Most homeowners insurance policies will cover your student's personal property in a campus dormitory up to the limits of your policy. However, this is typically not so if your child is living off-campus. If that is the case, then renters insurance is the coverage you will need.

Don’t Forget an Inventory

Regardless of whether homeowners insurance or renters insurance will apply, it is critical to have an inventory of all items in advance. A list of items the student is taking to college will be helpful of their property is stolen or damaged. Be sure to include the serial numbers as well as model, make and brand of each item along with a description and a photographic record (especially for items that are unique). Along with the inventory, keep receipts for expensive items to help establish value in case you must file a claim. Furthermore, it's important to advise your child about taking normal precautions to protect their belongings while they are away at school.

Attending to insurance coverage details and making good preparations before your teenager leaves for college will result in a smoother transition for both of you. For your own peace of mind, the key is to not assume you have adequate insurance coverage for your student's possessions at school without checking with your agent to be aware of all insurance options.

Here at the William M. Sparks Insurance Agency in Lutherville – Timonium MD, we help parents and students to sort through their insurance options when it comes time to head off to college; and we can answer your questions and help you, too. Feel free to contact us at your convenience for a no-obligation review of your homeowners insurance policy and a discussion of what might be your best course of action to protect your child's belongings.

Tag Cloud

|

|

|