Your boat is an important investment – even more important when you add accessories, equipment and a trailer. Here at the William M. Sparks Insurance Agency, Inc. in Timonium, Maryland, we can help you sort through the options and arrive at the best boat insurance coverage for your needs.

The type of boat insurance coverage you require depends upon the size, type and value of your boat and the water in which you use it.

Is Boat Insurance Needed for Small Boats?

Typically, small boats such as small sailboats, canoes and small power boats, may be covered under a renters, condo or homeowners policy.

What Does Boat Insurance Cover?

Larger, faster boats require a separate insurance policy and coverages usually include the following:

- Physical damage or loss – covers permanently attached equipment, machinery, furnishings and fittings as well as the hull. In the event of a physical loss or damage, reimbursement depends upon which of the following types of policies you have chosen.

- Agreed Amount Value – reimburses the previously agreed-upon (full or partial) value of your vessel.

- Actual Cash Value – reimburses replacement cost at the time of the loss, less depreciation.

- Property damage – covers damage to someone else’s property.

- Bodily injury – covers injuries caused to someone else.

- Medical payments – covers injuries to you and/or your passengers.

- Theft of your boat or its covered elements.

- Guest passenger liability – covers legal expenses of someone using the boat with your permission.

Liability limits, deductibles, additional coverages and discounts can vary to meet your needs.

Why not sit down with one of our capable agents who is experienced in boat insurance; and with their help, you can learn about available discounts and coverage choices to create just the right policy for your needs. Just contact us today to discuss how we can help or get a free quote.

The scope of your insurance coverage and options depend entirely upon the policy and the insurance company providing it. This website is not intended to advise, offer or bind coverage. You should always discuss your insurance issues with professionals such as a licensed and qualified insurance agent like those at the William M. Sparks Insurance Agency, Inc. before making any decisions or choosing a course of action.

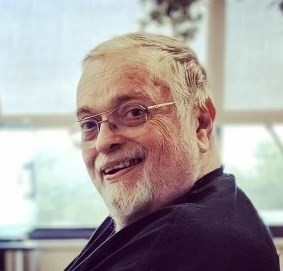

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023