Although you might not live near water, flooding can still cause significant – even devastating – damage to your home and property. Protection for flood damage is purchased separately from your standard homeowner or condominium insurance policy. Here at the William M. Sparks Insurance Agency in Timonium, Maryland, we know the guidelines and we can help you build the right flood insurance policy for your situation whether you are a resident of Maryland (MD), Virginia (VA) or Pennsylvania (PA).

Should Everyone Have Flood Insurance?

Flood insurance will protect you from losses incurred by flood damage to your home and belongings. It is available to you whether you are a homeowner or a renter. In fact, if you own a home located in a designated flood zone and you have a mortgage, your bank might require you to carry a flood insurance policy. Standard homeowners, condo and renters insurance do not cover damage caused by flood or surface waters.

When and Where Should One Purchase Flood Insurance?

Flood insurance is available through our agency, from the National Flood Insurance Program (NFIP). Even if you do not live in a designated flood zone, you should consider securing a flood insurance policy if your home and possessions are at risk from overflowing creeks, ponds, etc. You should plan to purchase your flood insurance policy well before flooding danger exists. There is at least a 30-day waiting period from the time you purchase the policy to the date it is effective.

What Does Flood Insurance Cover?

Flood insurance covers all types of homes and condos, but there are many limitations. If your home has been improved with a furnished, finished basement, those improvements are not covered by the NFIP policy. However, appliances and fixtures typically found in an unfinished basement will usually be covered. It will also pay for your possessions at a depreciated amount.

As a homeowner, you expect your house and everything in it - from the foundation to the roof – to be covered by your homeowners policy.

But did you know that flooding, which is the most expensive and common natural disaster in the United States, isn’t covered by most insurance policies? And while flood coverage can be required if you live in a high-risk zone, according to FEMA 25% of flood claims come from individuals living outside high-risk zones.

That’s where the Extended Water endorsement from Erie Insurance comes in.

What is Extended Water Coverage?

By adding this coverage to your ErieSecure® Home policy or adding it as part of an ErieSecure® Home Plus or Select bundle, you could have coverage for:

- Basements and other rooms that flood during a storm or various flooding events

- Water that backs up from sewers or drains

- Repair or replacement costs for both your home and personal property

- Additional living costs associated with temporarily relocating while your home is being restored

- Flood avoidance reimbursement (up to $10,000) to help proactively protect your home before flooding occurs

Why get Extended Water Coverage?

Extended Water is the protection you need from the backup of sewers, drains or floods, which also include inland flooding, tidal water, storm surge or mudflow and mudslide.

With Extended Water coverage, you get the peace of mind offered by Sewer or Drain Backup and Flood coverage. With this added protection from ERIE, you’ll have coverage for direct physical loss to your home, garage or other structures, and personal property that’s been damaged as the result of an extended water event. That also includes personal property in your basement.

Don’t wait until the water starts to rise. Get the details now. For more information about NFIP, visit www.fema.gov, or speak with one of our capable agents, experienced in the options and coverage choices of flood insurance who can help you get the answers you need to create just the right policy for your needs. Whether you live in MD, VA or PA, just contact us today to discuss how we can help.

The scope of your insurance coverage and options depend entirely upon the policy and the insurance company providing it. This website is not intended to advise, offer or bind coverage. You should always discuss your insurance issues with professionals such as a licensed and qualified insurance agent like those here in Timonium, MD at the William M. Sparks Insurance Agency before making any decisions or choosing a course of action.

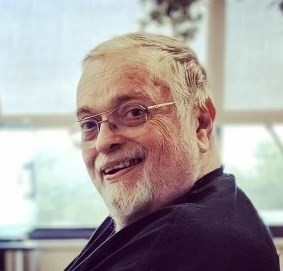

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023