William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

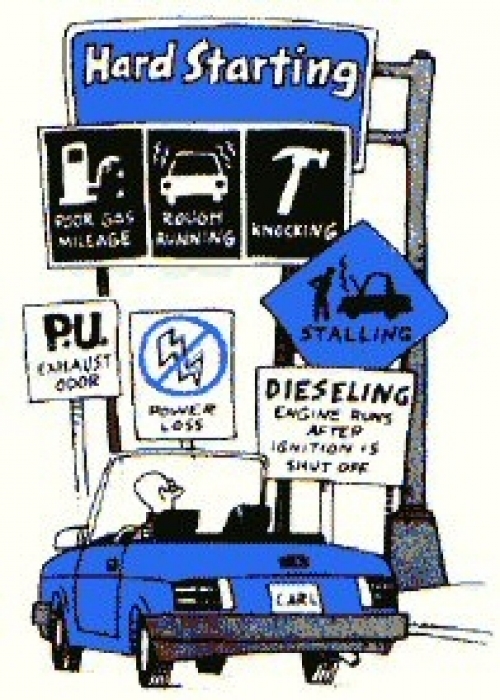

This Auto Maintenance Series is especially for car owners like yourself located in Maryland, Virginia and Pennsylvania who understand the need for vehicle safety and wish to protect their investment through on-going maintenance. As seasons change - especially during the heat of winter, assuring that your vehicle is road ready can be critical.

Taking good care of your windshield wipers and maintaining the wiper blades on your vehicle is more important than you might think. Part of safe driving is being aware of your surroundings. You must be able to rely on wipers that leave your windshield with a consistent, clean clear view when the weather takes a turn for the worse bringing rain or other inclement conditions. Obscured vision could cause you to collide with another vehicle or even drive off the road.

Your windshield wipers not only offer you clear vision during rain. They also keep your windshield clear of spattered mud, road tar, insects, bird droppings and other messy deposits. When your windshield wiper blades are worn, they will not remove such debris. Instead, theyoften smear the mess and obscure your vision even more. By switching out your wipers regularly, you avoid these problems and assure that your drive is safe.

When Should You Change Windshield Wipers

The first clue that your windshield wipers are past their physical prime is often streaking and skipping during use. You will also know that they need replacement when inspection shows discoloration,cracking and other signs of wear. Moreover, the wiper blades might chatter or squeak on your windshield when they need to be replaced. Some newer wiper blades come with a wear-indicator showing when they need to be replaced. The rule of thumb: Change them at least once per year (every six months is preferable).

Clean, intact windshield wiper blades could make a difference in your family's safety. So if you have been procrastinating about changing wiper blades, take a few minutes to make this a priority.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we want you to be safe and accident-free. As you prepare your vehicle for safe driving, don’t forget to see that your auto insurance coverage is up to date as well. And, if you have had recent changes in drivers or vehicles, check with your insurance agent to be sure that you are fully covered and are receiving the best rates available.

In this issue of the Homeowners Maintenance Series, we are moving to your home's attic – where sometimes-overlooked minor problems become major problems for tyour home's well-being and safety. Follow these tips for a safe and healthy attic…

Seal any unwanted openings...

Look for openings in your roof or attic walls that allow access to animals like birds, chipmunks, squirrels and others; and seal these openings. Whether or not you find such openings, it's still advisable to search the attic area for animal nests in case any critters have already made your attic their home.

Check out the insulation...

Be sure that you have enough insulation to keep your home cool in the summer and warm in the winter. If you're not sure how much you should have, check the guidelines at EnergyStar.gov. Next, examine for coverage, assuring that there are no bare spots in your insulation and that the insulation is not obstructing vents.

Check for moisture and leaks...

Typically, if you have a moisture problem, you will be able to smell mustiness and mildew. Be especially on the lookout for green algae or black mold; and, if found, you can kill it using a bleach/water solution. If you do find mold and remove it, you will want to check back periodically to assure that it was completelyeradicated and does not regrow.

Important Safety Advice...

Even if your attic appears to be free of outside breaches by animals and fromm moisture damage, be sure to inspectany electrical wiring and connections for wear, exposed wires and/or other damage; and, if found, arrange for a more thorough inspection and repair by a licensed electrician as soon as possible. FEMA reports that approximately 10,000 residential attic fires are reported each year, resulting in some 30 deaths, 125 injuries and $477 million dollars in property damage, with one-third of these fires spreading to involve the entire structure. The leading cause, according to FEMA, is electrical malfunction (about 43%); and the most common heat source for these attic fires is electrical arcing.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we strongly encourage you to be sure that your home is properly insured for fire damage and related injuries. To be sure you have adequate coverage, contact your insurance agent for an up-to-date assessment of your current homeowners policy.

This Homeowners Maintenance Series is especially for those homeowners around Maryland, Virginia and Pennsylvania who understand the need to protect their biggest investment and keep their home safe through regular maintenance. As summertime temperatures soar, preparing your home for the seasonal changes is important, and well-maintained air conditioning is top priority.

Central Air Conditioning

- Disconnect electric power to the outdoor condenser on your air conditioner before beginning inspection and maintenance.

- Your air conditioning unit must pull in enough outside air to cool and circulate inside your home. So, it is important to ensure that the outdoor condensing unit is free from obstruction by outdoor furniture, leaves, newspapers, debris, etc.

- Poor efficiency, reduced air flow and even evaporator icing can occur if the filters are clogged. So check the filter and clean or replace if/as necessary. You should replace disposable fiberglass filters, but you can wash electronic or electrostatic filters.

- Secure all access panels on your air conditioning unit and be sure no fasteners/screws are missing or loose.

Window-Mounted Air Conditioning

- Safety first -- before doing any maintenance, unplug the unit from the wall, remove the front access cover and the outdoor cover. You might even wish to completely remove the air conditioning unit from its mounting frame.

- Vacuum out the condenser coils with a soft brush attachment.

- Examine the condenser coil. If you notice any bent cooling fins, they may be straightened to avoidcompromised cooling capacity and air flow. To straighten the bent fins use a coil fin comb, matching the comb's teeth count to the coil finsl and then carefully drawing the comb across the bent coil fins to straighten them.

- Examine the foam filter and replace it if damaged. If intact but dirty, wash the filter with soapy water, rinse and dry before replacing.

- When maintenance is complete, return the unit to its frame before reinstalling the outside and front covers. Then, plug the unit back in the wall and run it for a few minutes to assure proper function.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we welcome the chance to help homeowners like yourself as you strive to protect your home and family. Don't forget to check with your insurance agent to assure that your home is still properly insured for its total value if you have upgraded the systems or made other home improvements in the recent past.

If your home or business has suffered significant damage, perhaps from fire or, as many did during the recent east coast natural disasters -- from the earthquake in Virginia to tropical storm Lee (and don't forget Hurricane Irene), then then finding a building contractor for repairs is undoubtedly a priority. The Federal Emergency Management Agency (FEMA) warns to exercise caution when choosing your contractors so that you avoid being a victim all over again.

You would be correct to suspect those who claim to be contractors seeking jobs by going door-to-door or handing out flyers, especially if they require you to sign a contract on the spot. Furthermore, be skeptical of those who require large up-front deposits or payment in full in advance. If they turn out to be unscrupulous, they will likely begin the job but then disappear before the work is done. Why? If your "contractor" turns out to be an unscrupulous scam artist to whom you pay a large amount up front, chance are that they will begin the job but will then disappear before completion.

It would be wise to ask a lot of questions if a so-called "contractor" proposes doing temporary repairs to your building's damage at a large cost before focusing on the issue of permanent repairs that will be ultimately needed.The Insurance Information Institute points out that the insurance settlement you receive is typically intended to cover both initial temporary repairs if/as necessary as well as permanent repairs for a given loss. Therefore, if a large portion of your funds are spent on such a temporary fix, it is possible that you will not have enough funds remaining to cover the permanent repair job. See more advice from the Insurance Information Institute (III): Beware Crooked Contractors (Video).

So how can you know that a contractor is honest and reputable before you sign any contract to have repair work done? Your best assurance will come choosing a contractor who haseither done work for you or someone else you trust in the past. Don't know such a contractor? Ask your insurance agent who can probably refer you to someone who is reliable. Likewise, your local building/trade associations might make a referral. But if you must use a contractor who has not done work for you before, regardless of the source of the referral, always check references before signing the contract.

Whether you are the victim of a widespread natural disaster or just a home or business owner with property in need of repairs, if you will be working with contractors, consider the following tips:

- If you have a loss due to property damage, be sure to contact your insurance agent as soon as possible to discuss your options and receive assistance.

- Check the contractor’s reputation and see if they have any complaints filed with the local builder/trade organizations or the Better Business Bureau.

- Ask for a written estimate that all work to be done and showing all taxes or other fees.

- Require a Certificate of Insurance from the contractor to be sure that the firm has active workers' compensation and disability insurance to cover any workers’ accidents. If not, then you could be liable for such accidents on your property.

- Obtain a written contract that specifies all associated costs and payment schedulefor the project. It should also lay out all work to be performed. Never sign a contract that is not comprehensive and specific.

- Determine who is responsible for obtaining all permits and licenses related to your job and insist that it be included in any contract that you sign.

- Ask for a written guarantee in which there is a stated duration as well as noting exactly what is guaranteed and whether there are any stipulations or restrictions.

- Make your payment by credit card or check but never by cash.

- Be sure to read carefully any contract cancellation clauses. You should be able to cancel a contract within three business days of signing.

Here at the William M. Sparks insurance Agency, we are experienced in helping our policyholders recover from losses with as little discomfort as possible. We'd be pleased to have you contact us at your convenience to discuss any of your insurance needs -- including how to be best prepared to handle damage to your home or commercial building.

By now, we all know about the tragedy of the cruise ship, Costa Concordia, that ran aground off the Tuscany coast recently. It has certainly dominated television and online news making it nearly impossible to avoid viewing the shocking scenes of that vessel on its side in the water.

By now, we all know about the tragedy of the cruise ship, Costa Concordia, that ran aground off the Tuscany coast recently. It has certainly dominated television and online news making it nearly impossible to avoid viewing the shocking scenes of that vessel on its side in the water.

Perhaps not surprisingly, the reality of the wreckage quickly found its way into our own backyard. Local and national news outlets including CBS Baltimore reported that a Maryland woman, Anna Figueredo, and her daughter were among the passengers and that they were two of the last to reach a lifeboat. Of course, Mrs. Figueredo and her daughter are safely back at home in Silver Spring, MD, undoubtedly glad to have survived the ordeal. It's safe to say that this is one trip that won't soon be forgotten.

Maritime commerce and pastimes are inherent in the culture of the midAtlantic region of our country. The use of our many waterways and seemingly endless miles of coastline is fundamental to our commercial and recreational survival. Therefore, the image of that disabled Italian cruise ship should emphasize to us the risks of boating accidents, regardless of the size of the vessel – from giant cruise ship to small fishing craft or pleasure boat.

In our local waters, running aground is certainly a risk. There are many causes. In our region, one that comes to mind occurs when there is a build-up of silt, sand and stone (often called shoaling) and often caused by storms and resultant heavy currents. However, the Insurance Information Institute (III) reminds us that there are thousands of recreational boating accidents per year with other contributing factors ranging from ignoring boating regulations, lack of boating experience to traveling too fast for water or weather conditions, to driving under the influence of drugs or alcohol, just to name a few.

Although commercial boating is a year-round operation, the recreational boating is more seasonal and might be months away; but it will be here before you know it. Why not prepare now to have your boat ready when the season arrives? The U.S. Coast Guard Auxiliary offers free advice and boating safety courses. In fact, just for the asking, the auxiliary will perform a full Courtesy Marine Examination (CME) of your vessel. They award a CME decal “Seal of Safety” to all boats that meet the standards. Learn more about the CME.

Just as important as checking the safety of your vessel is checking your boat insurance coverage. Perhaps this is a good time to sit down with one of our experienced agents who can help you determine whether your insurance policy provides the proper coverage at the best rates possible. Just contact us at your convenience to discuss your boating insurance.

Tag Cloud

|

|

|