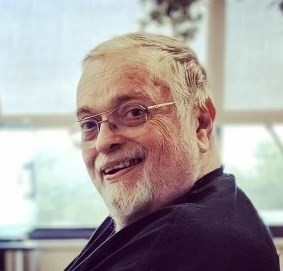

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

If the love of your life has chosen Valentine’s Day to pop the question, then we send our congratulations and best wishes to both of you. Take your time. Savor the moment, and make it a cherished memory. But then we hope you’ll remember the practical side of owning that beautiful diamond ring. You might not be “thinking insurance” but we are. The Insurance Information Institute tells us that one of the most frequent of all homeowners’ content-related insurance claims is for the loss of valuable jewelry. We know that you’ll want to see that your new engagement ring is financially protected in case it is lost, stolen or damaged.

If the love of your life has chosen Valentine’s Day to pop the question, then we send our congratulations and best wishes to both of you. Take your time. Savor the moment, and make it a cherished memory. But then we hope you’ll remember the practical side of owning that beautiful diamond ring. You might not be “thinking insurance” but we are. The Insurance Information Institute tells us that one of the most frequent of all homeowners’ content-related insurance claims is for the loss of valuable jewelry. We know that you’ll want to see that your new engagement ring is financially protected in case it is lost, stolen or damaged.

Click on READ MORE below to learn the steps to protect your ring as soon as possible…

It’s that time of year when we all decide the improve ourselves. We set out New Year’s resolutions, usually designed to enhance our health or our appearance. Those are admirable goals for sure. But if you’ve been there and done that, year after year, you might be ready for something fresh – something that will polish your skills and keep you safe at the same time.

It’s that time of year when we all decide the improve ourselves. We set out New Year’s resolutions, usually designed to enhance our health or our appearance. Those are admirable goals for sure. But if you’ve been there and done that, year after year, you might be ready for something fresh – something that will polish your skills and keep you safe at the same time.

We’re talking about resolutions to become a better driver. To make it a little easier for you, click on READ MORE below for some suggested resolutions to keep you safe on the road...

We are a society that depends on our vehicles. Just look at our landscapes – dotted with parking lots everywhere. We are accustomed to parking and leaving our cars unattended, sometimes for long periods of time most often with no concern. However, your parked vehicle can be a prime target for thieves known as Parking Lot Pilferers.

We are a society that depends on our vehicles. Just look at our landscapes – dotted with parking lots everywhere. We are accustomed to parking and leaving our cars unattended, sometimes for long periods of time most often with no concern. However, your parked vehicle can be a prime target for thieves known as Parking Lot Pilferers.

This is especially true in peak shopping seasons such as Christmas when people tend to do high volumes of shopping and stow their purchases in their car as they go about shopping in different stores. These thieves will often lurk around parking lots, targeting those vehicles in which they can see packages or other valuables. They have no interest in stealing the car but will gain access to items in plain view by breaking the window or punching the lock.

So how can you protect against such a crime or at least diminish the risk? Here are some tips that could help you avoid damage to your vehicle or loss of personal belongings.

- Always lock your doors, even if you know you’ll be right back.

- Close all of the car windows when leaving your car unattended.

- Always try to leave your vehicle in well-lit area with traffic moving about.

- Avoid parking near larger vehicles or shrubs that tend to hide your car from view. Thieves prefer such isolated vehicles because they can break in without being seen.

- Do not keep any personal items in plain view by someone walking past the car.

- Be sure to secure all packages out of sight before leaving your vehicle.

- Remove all portable accessories, such as GPS units and other electronics when leaving your car.

Auto Insurance Tip

Don’t wait until you have become a victim of a Parking Lot Pilferer. Check with your Insurance Agent to be sure that such thefts and damages are covered by your auto insurance and/or homeowners insurance.

Feel free to contact any of our very capable and experienced agents at the William M. Sparks Insurance Agency here in Lutherville/Timonium, MD to discuss your insurance questions. We can help you review your current insurance policy and explore your options to be sure you have the best coverage and protection according to your circumstances.

Winter brings an increased risk for fires and other disasters. This is even more of a risk during the holidays when everyone is busy gathering with friends and family this time of year, it’s easy to overlook some simple safety measures that can reduce the risk of damage during the holidays.

Winter brings an increased risk for fires and other disasters. This is even more of a risk during the holidays when everyone is busy gathering with friends and family this time of year, it’s easy to overlook some simple safety measures that can reduce the risk of damage during the holidays.

- If you hang stockings on the fireplace mantle, then be sure to move them away from the fireplace before lighting a fire, and keep other decorations away from open flames and power receptacles and plugs. Statistics show that 20% of home fires that occur in December are the result of decorations that are too close to heat sources.

- Be sure your Christmas lights are used appropriately. Avoid using indoor lights in the outdoors, and vice versa; and see that the lights you use have been properly rated for their intended use. Take a moment to check each strand of lights for frayed or bare wires, damaged sockets and loose connections. If you expect to be stringing your lights together, limit to three strands to avoid overloading your extension cord.

- Consider battery operated candles as opposed to real candles to avoid a fire hazard. When using real candles, do not leave them unattended or where they can be easily knocked over.

- Avoid using lights on metallic trees which could become charged with electricity if the lights are not in good condition. Someone touching such a charged tree could be accidently electrocuted.

- When leaving the premises or going to bed, make sure to turn off all decorative lights. Keep live trees well-watered so they remain hydrated while in use. A tree that dries out can become a fire hazard if exposed to decorative lights,

View this video from the National Fire Prevention Association (NFPA) for more useful tips....

Home Insurance Tips

Be mindful of the risk of homeowners liability claims. Keep the front door and walkways well-lit and free of obstacles that could be a tripping or falling hazard for your visitors. In particular, if you decorate your lawn with any blow-up decorations that must be anchored in the lawn, monitor them to be sure they do not shift and obstruct your visitors’ path. The holidays can be busy for everyone and will be likely full of activities. A few practical precautions can help you and your loved ones to enjoy an accident-free season and can prevent you from having to file homeowners insurance claims when you would rather be celebrating.

Feel free to contact any of our very capable and experienced agents at the William M. Sparks Insurance Agency here in Lutherville/Timonium MD to discuss your home insurance. We can help you review your current insurance policy and explore your options to be sure you have the best coverage and protection according to your circumstances.

Your vacation plans are made and you’re all packed and ready to go. But wait, shouldn’t you let all your online friends know that you’ll be away? The answer is a big NO. Your pre-vacation posts could make you a prime target according to the Electronics Security Association (esaweb.org) who says an estimated 75% of burglars are using social media to find targets. These criminals spend their online time trolling social media to find out whose house will be empty and when. With that knowledge, it is an easy task for them to gain access to your empty home and take their time removing all that they wish to take. In fact, burglars are known to steal higher end items if they know they have as much time as they need.

Your vacation plans are made and you’re all packed and ready to go. But wait, shouldn’t you let all your online friends know that you’ll be away? The answer is a big NO. Your pre-vacation posts could make you a prime target according to the Electronics Security Association (esaweb.org) who says an estimated 75% of burglars are using social media to find targets. These criminals spend their online time trolling social media to find out whose house will be empty and when. With that knowledge, it is an easy task for them to gain access to your empty home and take their time removing all that they wish to take. In fact, burglars are known to steal higher end items if they know they have as much time as they need.

So how do you avoid being a victim of these online burglars? Following these social media safety tips will help you to protection of your property and belongings when it counts the most.

- Vacation plans — Avoid announcing in advance your vacation plans – when you’ll leave and return, where you will go. If you must share, do so by text to just those who are closest to you. There will be plenty of time to share your vacation events when you return. Don’t give the burglars an invitation to break and enter your home.

- Location — If you believe that there is any chance that you have been targeted by burglars who have tracked your online activities, you won’t want to help them further by also showing your GPS location. Whether during your trip or just at home, keep your location private by disabling GPS location-identifying settings,

- Pricy purchases — If you purchase high-end or expensive items on your trip, it’s best not to post a photo of them? Online thieves also track posts of expensive items and could be motivated to target your home to steal such items. So yes, you would still be a target upon your return.

- Hidden data — When you take a picture with your digital camera or your phone and save it, part of what is saved in a collection of hidden data (called EXIF) which includes when and where the photo was and much more. Although some social media outlets do automatically exclude EXIF data but others do not. If you’ll be uploading photos that can be captured by others, consider removing this data before you share. In fact, you can find the simple steps to removing the EXIF data here

- Photos — Delay the posting of your vacation photos to social media until you are safely back home; and when you do eventually post your photos, remember to include the hashtag #latergram to let your social media friends know that the photo was taken earlier. If you really must share your photos in real time, then upload them to an account on Google Photos where you can share them only with those you designate. Otherwise, online thieves trolling for victims will know you’re away from home.

- Privacy — Be proactive. Long before criminals have the chance to find you online, be sure your social media settings are set to “private” or “friends only” to be sure no unwanted strangers see your posts.

Homeowners Insurance Tip

Before you leave for your vacation, take all precautions to thoroughly secure your home and property. Let a trusted neighbor know that you will be away and share your itinerary. But also have a conversation with your insurance agent to be sure that your home is sufficiently covered for any damage or theft that might occur in your absence. If you are concerned about theft of your personal data through social media, it is advisable to also explore your options for identity recovery, should you need to pursue it.

Tag Cloud

|

|

|