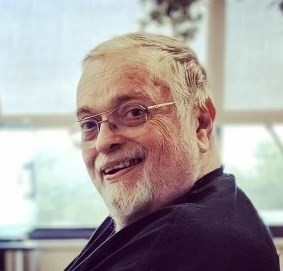

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

If your home or business has suffered significant damage, perhaps from fire or, as many did during the recent east coast natural disasters -- from the earthquake in Virginia to tropical storm Lee (and don't forget Hurricane Irene), then then finding a building contractor for repairs is undoubtedly a priority. The Federal Emergency Management Agency (FEMA) warns to exercise caution when choosing your contractors so that you avoid being a victim all over again.

You would be correct to suspect those who claim to be contractors seeking jobs by going door-to-door or handing out flyers, especially if they require you to sign a contract on the spot. Furthermore, be skeptical of those who require large up-front deposits or payment in full in advance. If they turn out to be unscrupulous, they will likely begin the job but then disappear before the work is done. Why? If your "contractor" turns out to be an unscrupulous scam artist to whom you pay a large amount up front, chance are that they will begin the job but will then disappear before completion.

It would be wise to ask a lot of questions if a so-called "contractor" proposes doing temporary repairs to your building's damage at a large cost before focusing on the issue of permanent repairs that will be ultimately needed.The Insurance Information Institute points out that the insurance settlement you receive is typically intended to cover both initial temporary repairs if/as necessary as well as permanent repairs for a given loss. Therefore, if a large portion of your funds are spent on such a temporary fix, it is possible that you will not have enough funds remaining to cover the permanent repair job. See more advice from the Insurance Information Institute (III): Beware Crooked Contractors (Video).

So how can you know that a contractor is honest and reputable before you sign any contract to have repair work done? Your best assurance will come choosing a contractor who haseither done work for you or someone else you trust in the past. Don't know such a contractor? Ask your insurance agent who can probably refer you to someone who is reliable. Likewise, your local building/trade associations might make a referral. But if you must use a contractor who has not done work for you before, regardless of the source of the referral, always check references before signing the contract.

Whether you are the victim of a widespread natural disaster or just a home or business owner with property in need of repairs, if you will be working with contractors, consider the following tips:

- If you have a loss due to property damage, be sure to contact your insurance agent as soon as possible to discuss your options and receive assistance.

- Check the contractor’s reputation and see if they have any complaints filed with the local builder/trade organizations or the Better Business Bureau.

- Ask for a written estimate that all work to be done and showing all taxes or other fees.

- Require a Certificate of Insurance from the contractor to be sure that the firm has active workers' compensation and disability insurance to cover any workers’ accidents. If not, then you could be liable for such accidents on your property.

- Obtain a written contract that specifies all associated costs and payment schedulefor the project. It should also lay out all work to be performed. Never sign a contract that is not comprehensive and specific.

- Determine who is responsible for obtaining all permits and licenses related to your job and insist that it be included in any contract that you sign.

- Ask for a written guarantee in which there is a stated duration as well as noting exactly what is guaranteed and whether there are any stipulations or restrictions.

- Make your payment by credit card or check but never by cash.

- Be sure to read carefully any contract cancellation clauses. You should be able to cancel a contract within three business days of signing.

Here at the William M. Sparks insurance Agency, we are experienced in helping our policyholders recover from losses with as little discomfort as possible. We'd be pleased to have you contact us at your convenience to discuss any of your insurance needs -- including how to be best prepared to handle damage to your home or commercial building.

By now, we all know about the tragedy of the cruise ship, Costa Concordia, that ran aground off the Tuscany coast recently. It has certainly dominated television and online news making it nearly impossible to avoid viewing the shocking scenes of that vessel on its side in the water.

By now, we all know about the tragedy of the cruise ship, Costa Concordia, that ran aground off the Tuscany coast recently. It has certainly dominated television and online news making it nearly impossible to avoid viewing the shocking scenes of that vessel on its side in the water.

Perhaps not surprisingly, the reality of the wreckage quickly found its way into our own backyard. Local and national news outlets including CBS Baltimore reported that a Maryland woman, Anna Figueredo, and her daughter were among the passengers and that they were two of the last to reach a lifeboat. Of course, Mrs. Figueredo and her daughter are safely back at home in Silver Spring, MD, undoubtedly glad to have survived the ordeal. It's safe to say that this is one trip that won't soon be forgotten.

Maritime commerce and pastimes are inherent in the culture of the midAtlantic region of our country. The use of our many waterways and seemingly endless miles of coastline is fundamental to our commercial and recreational survival. Therefore, the image of that disabled Italian cruise ship should emphasize to us the risks of boating accidents, regardless of the size of the vessel – from giant cruise ship to small fishing craft or pleasure boat.

In our local waters, running aground is certainly a risk. There are many causes. In our region, one that comes to mind occurs when there is a build-up of silt, sand and stone (often called shoaling) and often caused by storms and resultant heavy currents. However, the Insurance Information Institute (III) reminds us that there are thousands of recreational boating accidents per year with other contributing factors ranging from ignoring boating regulations, lack of boating experience to traveling too fast for water or weather conditions, to driving under the influence of drugs or alcohol, just to name a few.

Although commercial boating is a year-round operation, the recreational boating is more seasonal and might be months away; but it will be here before you know it. Why not prepare now to have your boat ready when the season arrives? The U.S. Coast Guard Auxiliary offers free advice and boating safety courses. In fact, just for the asking, the auxiliary will perform a full Courtesy Marine Examination (CME) of your vessel. They award a CME decal “Seal of Safety” to all boats that meet the standards. Learn more about the CME.

Just as important as checking the safety of your vessel is checking your boat insurance coverage. Perhaps this is a good time to sit down with one of our experienced agents who can help you determine whether your insurance policy provides the proper coverage at the best rates possible. Just contact us at your convenience to discuss your boating insurance.

As a responsible employer, your first concern is keeping your employees healthy and injury-free. During flu season, it is particularly important to take precautions in the workplace to prevent the spread of the flu virus. But how much do you really know about the Flu? Why not test your Flu IQ...

It is that time once again -- to “fall back” -- turning back our clocks to regain that hour we lost in the spring. As we end Daylight Savings Time and return to standard time, it's the perfect time to change our smoke alarm batteries. We are all about safety here at the Sparks Insurance Agency, so we urge you to get into the habit of changing smoke alarm batteries either at the end or the beginning of Daylight Savings Time to keep your family safe and to avoid homeowners insurance claims by protecting your home from fire and smoke damage.

The value of a reliable smoke alarms in our homes is indisputable. However, having a smoke alarm isn't enough. A good fire safety plan requires that the smoke alarms actually are reliably working. Adopting the habit of doing a quick check of your smoke alarms each month will ensure that they are working properly, and changing the batteries at least once a year will ensure that their batteries remain fresh and strong.

If Neglected, Smoke Alarms Might Stop Working

Smoke alarms can stop working for several reasons. Sometimes it is because they have outlived their usefulness, especially if they are more than 10 years old. More commonly, however, these alarms fail to do their job of alerting you to the danger of fire and smoke because their battery is dead or missing or because the smoke alarm has been disconnected. In fact, the National Fire Protection Association (NFPA) warns that almost two-thirds of home fire deaths in 2005-2009 resulted from fires in homes with no smoke alarms or non-working smoke alarms.

What if Your Smoke Alarm Fails to Remind You

Perhaps you are thinking you could just wait until the smoke alarm beeping alerts you that the batteries need to be replaced. That's a bad idea for many reasons such as…

- If you are not at home during time when the beeping alert begins until your smoke alarm batteries go totally dead, you might not be aware that they are not working. This leaves your family and your home unprotected against fire.

- If you don't have replacement smoke alarm batteries ready when the alert occurs, you might be tempted to stop the beeping by removing the batteries or disconnecting your smoke alarm. Of course, this increases your risk of not being alerted in case of a fire until you get your smoke alarm working again.

When Replacing Smoke Alarm Batteries...

- Avoid using rechargeable batteries in your smoke alarm. Smoke alarm manufacturers advise against them. Install the correct type of replacement battery -- the one recommended in the manual or label on your smoke alarm; and be sure to follow all directions.

- If your smoke alarm is giving you frequent nuisance alarms, then it’s time to replace the entire smoke alarm unit. Don’t be tempted to just disconnect the battery to stop the nuisance alarms.

- Almost all smoke alarms batteries should be replaced each year, including those in hard-wired smoke alarms with battery backup. This applies to all smoke alarms except those that are hard-wired and do not include a battery backup or smoke alarms that have a built-in 10-year battery that cannot be replaced. In the latter case, you would replace the complete smoke alarm every 10 years.

- Remember to change the batteries in your carbon monoxide alarm at the same time that you change your smoke alarm batteries.

- Take the opportunity to clean your smoke alarm at the time that you change the batteries each year.

- More About Home Smoke Alarms from the NFPA (Video)

- Smoke Alarms: Installation and Maintenance Tips

- Smoke Alarm Types: Ionization vs. Photoelectric

Halloween can be a holiday full of festivities, fun and costumes or it can be the cause of accidents or worse. If you follow a few tips to ensure safety and protect your home from liability, you can prevent the risk of a homeowners insurance claim spoiling the fun.

Will you be hosting a Halloween party or welcoming trick-or-treaters to your door? Either way, opening your property to the public can leave you vulnerable to insurance claims and lawsuits.

The following 10 Tips will assure Halloween home safety...

- Create a Clear Path –Prevent visitors after dark don’t stumble and injure themselves by keeping the area around your home unobstructed. Especially at Halloween, clear your lawn and walkways of toys, lawn ornaments, gardening equipment, etc. to help avoid a liability.

- Keep the Lights On – Be sure that trick-or-treaters and other visitors are able to see clearly after dark to a fall on your property. You will not only help avoid a liability claim, but you’ll deter burglars who are always less inclined to approach a well-lit home.

- Confine Your Pets for Protection – Dogs and cats could jump on or even bite unfamiliar visitors -- especially those in costume. For the safety of your guests as well as your pets, keep dogs and cats away from the front porch or open areas.

- Be Smart About Pumpkin Carving – Leave the pumpkin-carving to the adults this Halloween and encourage them to use a special pumpkin cutter for extra safety. Allow children to help with the design before carving.

- Jack-o-Lantern Safety – Jack-o-Lanterns left unattended can easily be tipped over by trick-or-treaters or pets. If they are lit by candles, that could have a disastrous consequence. Avoid fire damage claims by using a battery-powered light in your pumpkin.

- Avoid Open Flames – Just as with Jack-o-Lanterns, setting the spooky Halloween mood with candles and luminaries that can easily be overturned, could result in homeowners insurance claims for fire damage. Consider light sticks or battery-powered lighting instead.

- Think Before You Serve – Remember that you are responsible for the safety of guests who will visit your home this Halloween. Trick-or-treaters should be given only commercially-packaged treats. Likewise, be sure to protect those who will be driving later by serving non-alcoholic beverages to your older party guests; and, of course, avoid serving alcohol to anyone who is under-age. Thinking of the mood at your party by using dry ice in a punchbowl, be sure to keep the chips out since they can cause severe injury if ingested.

- Assure Home Security – Will you be away from home during Halloween? Remember to set your security alarm system before you depart. Typically, Halloween season is a prime time for mischief and burglaries. Don't forget to also activate motion-sensitive lights, and alert your neighbors if you will not be at home.

- Test Your Home Smoke Alarms – While you are testing your home security system, don’t forget to test your smoke alarms well in advance of the Halloween celebrations to minimize the chance of having a claim for fire damage.

- Check Your Homeowners Insurance – Take a moment to speak with your insurance agent to be sure you will be fully protected for whatever plans you have for the Halloween Holiday. The time to find out that your coverage is incomplete is NOT after you have a claim.