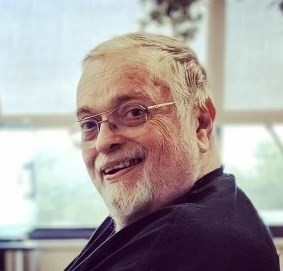

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

Car Shopping Now Quicker, Easier and Safer

It’s a brand new year. Is this the year when you’ll replace that old car? Perhaps you’re thinking about it, but dreading all the research you’d have to do to decide on a new model that meets your family’s needs.

Would it be easier if you could find out the safety rating of the makes and models you’re considering – right there in the car lot? Well now you can do just that using your smart phone? Think of the time you’ll save!

You might ask why check a car’s safety rating before buying. Not only is it important that your new vehicle offer you and your family the best protection in a crash, but the safety rating also influences your auto insurance bill.

Now, the Insurance Institute for Highway Safety (IIHS), has made it easy for car shoppers to check on the auto safety ratings and crash test results while browsing on the dealer’s showroom floor or anywhere else. The Institute has launched a new mobile website so consumers can easily compare vehicle safety ratings.

In fact, the site does much more. You can also compare child booster seat ratings, the latest highway safety news and much more. You can also use your smart phone to sign up for an automatic RSS feed when new material is available.

The IIHS routinely publishes the results of tests showing the performance of a given car, truck, SUV or van in protecting passengers in front, rear and side impact crashes as well as in rollovers. Depending upon how they perform, each vehicle is rated as good, acceptable, marginal or poor. Vehicles that perform to the highest standards receive the distinction of TOP SAFETY PICK.

Auto Insurance Tip

If you’re in the market for a new or used car, don’t forget to get your insurance agent’s input in advance. In fact, our experienced agents, here at the William M. Sparks Insurance Agency in Timonium, MD, are ready to help you with all your insurance questions. Just contact us at your convenience.

Identity Theft Myth #1: Shredding my mail and other documents will protect me from identity theft

We all know at least one person who uses their home shredder to diligently destroy all to-be-discarded documents and postal mail and removes all labels bearing their name, address, phone or any other personal information. Perhaps you do it yourself. The good news: shredding documents that contain personal information before you throw them away is a very good habit to have. It is the best way to disappoint any "dumpster diving" thieves who might search your garbage to find your personal information.

But if that is all that you do, then you are leaving yourself open to identity theft in many other ways. Do you store your auto registration, insurance cards and/or auto repair receipts in your car? Do you ever leave bills, checkbooks and documents lying on the kitchen counter or desk where they may be viewed by visitors or service technicians in your home? Do you store personal identification and other details on your computer without password protection? Do you provide personal information when contacted by phone or e-mail as long as you recognize the company on your caller ID or computer? Do you keep a cheat sheet of computer passwords on your desk at work? Avoiding identity theft and related fraudulent crimes means that you must think defensively at all times. This means securing your personal information in your car, your office and your home; and always practice safe online security habits.

Deterring Identity Theft

Unfortunately, there is no guarantee that you will never become a victim of identity theft. Learn more about Identity Theft and how to minimize your risk.

Avoiding Identity Crime Online

Read about the common-sense ways to assure computer security and protect yourself from identity theft and related fraud without minimizing your ability to use today's technology.

But What if Identity Theft Happens?

The bad news is that you might not even know if you are a victim of identity theft for a very long time. In fact, until you find that accounts are open in your name that you did not create or you receive notice of tax or legal violations or perhaps your bank account is emptied. When you realize what has happened, then you must begin the long, frustration and often expensive process of restoring your reputation and recovering your identity.

Identity Recovery Insurance

The good news is that you can take measures to protect yourself through Identity Recovery Insurance which will offer guidance, assistance and most importantly financial benefits to help you move forward.

Many of the major insurance carriers today offer this coverage, and the method differs. Some offer a stand-alone policy while some offer coverage as a part of a homeowners insurance pollicy. Still others offer it as an endorsement.

So, how do you get this coverage?

You should start by asking your insurance agent. In fact, here at the William M. Sparks Insurance Agency in Timonium, MD, our experienced agents can give you all the details and help you make the choices needed to assure that you have a place to start and a helping hand to recover from identity theft. Why not contact us to find out what your options might be -- now... before you ever need it.

If you have a teenager headed to college this year, toting a computer and cell phone as well as all the other valuable digital items, have you considered what happens if these items were to be vandalized, stolen, damaged or destroyed? Would your homeowners policy provide the coverage to replace your student's possessions while away at college?

With all the other worries when your kids are going to college, this is one you don't need to suffer. It's possible to protect your kids' valuables with insurance.And, if you do your homework and check out your options, you can avoid the risks of being caught unaware about your homeowners insurance coverage.

We recommend sitting down with your child to list all items that will be moved to campus so that you can put a value on each item.

Next, contact your insurance agent and verify the extent of coverage and limitations on your current homeowners insurance policy. Once you know the maximum coverage limit provided by your homeowners insurance for your student, it's a simple matter to compare it to the total value of your child's belongings. If, the maximum amount of allowable coverage falls short of the total value of the items, you’ll be able to increase your coverage before there is a need to file a claim.

Your insurance agent will need to know whether your child will be living on campus or in an off-campus dewlling. Most homeowners insurance policies will cover your student's personal property in a dorm up to the limits of your policy but not if he/she will be living off-campus. Instead, you will need to consider renters insurance.

Regardless of the type of insurance needed, you'll want to create an inventory ahead of time of all items – with serial numbers, descriptions, and other details – andlet your teen know about taking normal precautions to protect their belongings.

Be prepared, learn about your insurance coverage before sending your child off to campus, and it will mean a smoother transition for both of you. The key: Don't just assume that your kids' possessions at schoolare fully insured. Instead, check with your agent to understand all insurance options.

Here at the William M. Sparks Insurance Agency, we often help parents as they sort through their options when the time for college is close. We can assist you and answer your questions. Why not contact us at your convenience for a no-obligation review of your homeowners insurance policy and a discussion of what might be your best course of action.

Keeping your deck safe and ready for summer fun can be a challenge for homeowners like yourself. In this issue of the Homeowners Maintenance Series, offer the following tips to enjoy outdoor entertaining on your deck and still avoid insurance claims .

Keeping your deck safe and ready for summer fun can be a challenge for homeowners like yourself. In this issue of the Homeowners Maintenance Series, offer the following tips to enjoy outdoor entertaining on your deck and still avoid insurance claims .

First, examine your deck for loose stairs and/or deck railings and for any warped or excessively work boards. Be sure to replace or repair them if/as needed.

If the decking surface shows staining where the deck joins the house, it likely indicates water leakage; so you'll need to check further for wood decay which can weaken the deck’s structural integrity. If you suspect that the structure is compromised, then consider contacting a decking professionalfor a professional opinion and advice or repair as needed.

Moss and mold will cause your deck's surface to become slippery – a hazard for your family and other visitors. But you can easily remove this growth through pressure washing the surface. If you do your own pressure washing instead of hiring a pro to do the job, then take the time to fully understand how to use the equipment properly and safely before you begin.

If resealing your deck is necessary -- either because of general wear or because power washing has to be done, then be sure to investigate and purchase the best product for the job and avoid shotcuts that could compromise the result. Otherwise, you will find yourself re-doing the job within a year.

Examine and test your deck lighting and any wiring for signs of wear or malfunction. Replace bulbs or light fixtures as needed; but, if you have sophisticated outdoor wiring and/or lighting that shows malfunction, then consider having a licensed electrician do a check-up.

part of maintaining the value of your home is caring for your deck. But,perhaps more importantly, by maintaining your deck properly you’ll be protecting yourself from injury claims against your homeowners insurance policy.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we recommend that you to check with your insurance agent for a review of your homeowners policy if you have not done so recently. This allows that you will have adequate liability coverage as you use your deck for recreation and entertaining this summer.

Find out more about Homeowners Insurance.

Is your family like the many others who eagerly anticipate summer road trips? If you have done a summer road trip in the past, then you know that you can't just hop in the car and go. Before you drive off to enjoy the open road, it's important to be prepared for your trip. Take the time to check the vehicle you'll be driving and to pack properly; but remember to review your auto insurance policy. Following these few guidelines should make your road trip the kind of memorable adventure that you and your passengers hope for.

Have your car checked by your mechanic...

The National Highway Traffic Safety Administration (NHTSA) has published some great advice for planning a safe and stress-free summer road trip. Of course, it includes doing a complete inspection of the vehicle you'll be driving. They caution not to wait until the last minute. They recommend that you check the following systems on your car, truck, SUV or van well in advance of your road trip. Some or all of these checks should be done by a trusted mechanic.

- Cooling System —coolant level and need for service

- Fluid Levels — engine oil, windshield, transmission, brake, and power steering fluids

- Hoses and Belts —fittings and signs of wear

- Air Conditioning System – components and cooling function

- Lights — interior lights, turn signals, emergency flashers, headlights, brake lights and trailer lights, if any

- Tires – air pressure and wear on the tread for all tires including spare tire

- Wiper Blades – wear and tear on both passenger’s and driver’s sides

Check your insurance with your agent...

Will you be doing all the driving or sharing the driving with someone else? Will you be driving your own vehicle, someone else's or a rental car? Your auto insurance agent can help you assure that you will have proper coverage, no matter what your arrangements. Don't wait until after an accident occurs only to find that your insurance will not cover your claim.

Will you rent a car for your road trip?

Although the car rental company can provide insurance coverage, your current auto insurance policy might cover your rental vehicle. Moreover, your credit card company might also offer some reimbursement, should there be an accident. Well before the time for your trip, take the time to ensure that you will be fully covered but without duplication by finding out what coverages the rental company offers and what options the credit card company offers and then by calling your insurance agent for advice. To learn more, see what the Insurance Information Institute (III) advises regarding car rentals and insurance.

Be prepared, in advance, for roadside emergencies...

Seasoned travelers recommend packing a Roadside Emergency Kit to help, should you be stranded during your road trip. The National Highway Traffic Safety Administration (NHTSA) suggests that your kit should include fresh drinking water, non-perishable food, a flashlight,basic repair tools, jumper cables, flares and white flag as well as work gloves. Of course, you will want to take along a cell phone and have a charger in the vehicle. Even though GPS devices are popular navigational tools, it's still wise to take along a map of your travel route as a back-up reference.

Plans Complete? Enjoy your trip...

Whether you plan all stops in advance or pick your route and make your plans on the fly as you go, the time you devote to preparing before taking to the road will e time very well spent.