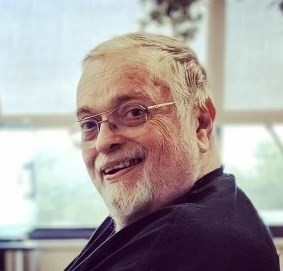

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

Auto - Homeowners - Business Insurance for

Lutherville, Timonium & Cockeysville, Maryland

Find the best rates and the best terms on homeowners, renters, condo and flood insurance as well as auto, boat and motorcycle insurance for you and your family.

We help you create a good business/commercial insurance package designed especially to fit your industry and offer your company the best coverage.

This popular financial tool can be used for many purposes besides just paying for you final expenses, depending on the type of policy you choose.

As an independent insurance agency, we will do the research and compare a number of insurance carriers to give you the best options and rates to meet your needs.

Although you might not live near water, flooding can still cause significant – even devastating – damage to your home and property. Protection for flood damage is purchased separately from your standard homeowner or condominium insurance policy. Here at the William M. Sparks Insurance Agency in Timonium, Maryland, we know the guidelines and we can help you build the right flood insurance policy for your situation whether you are a resident of Maryland (MD), Virginia (VA) or Pennsylvania (PA).

Should Everyone Have Flood Insurance?

Flood insurance will protect you from losses incurred by flood damage to your home and belongings. It is available to you whether you are a homeowner or a renter. In fact, if you own a home located in a designated flood zone and you have a mortgage, your bank might require you to carry a flood insurance policy. Standard homeowners, condo and renters insurance do not cover damage caused by flood or surface waters.

When and Where Should One Purchase Flood Insurance?

Flood insurance is available through our agency, from the National Flood Insurance Program (NFIP). Even if you do not live in a designated flood zone, you should consider securing a flood insurance policy if your home and possessions are at risk from overflowing creeks, ponds, etc. You should plan to purchase your flood insurance policy well before flooding danger exists. There is at least a 30-day waiting period from the time you purchase the policy to the date it is effective.

What Does Flood Insurance Cover?

Flood insurance covers all types of homes and condos, but there are many limitations. If your home has been improved with a furnished, finished basement, those improvements are not covered by the NFIP policy. However, appliances and fixtures typically found in an unfinished basement will usually be covered. It will also pay for your possessions at a depreciated amount.

As a homeowner, you expect your house and everything in it - from the foundation to the roof – to be covered by your homeowners policy.

But did you know that flooding, which is the most expensive and common natural disaster in the United States, isn’t covered by most insurance policies? And while flood coverage can be required if you live in a high-risk zone, according to FEMA 25% of flood claims come from individuals living outside high-risk zones.

That’s where the Extended Water endorsement from Erie Insurance comes in.

What is Extended Water Coverage?

By adding this coverage to your ErieSecure® Home policy or adding it as part of an ErieSecure® Home Plus or Select bundle, you could have coverage for:

- Basements and other rooms that flood during a storm or various flooding events

- Water that backs up from sewers or drains

- Repair or replacement costs for both your home and personal property

- Additional living costs associated with temporarily relocating while your home is being restored

- Flood avoidance reimbursement (up to $10,000) to help proactively protect your home before flooding occurs

Why get Extended Water Coverage?

Extended Water is the protection you need from the backup of sewers, drains or floods, which also include inland flooding, tidal water, storm surge or mudflow and mudslide.

With Extended Water coverage, you get the peace of mind offered by Sewer or Drain Backup and Flood coverage. With this added protection from ERIE, you’ll have coverage for direct physical loss to your home, garage or other structures, and personal property that’s been damaged as the result of an extended water event. That also includes personal property in your basement.

Don’t wait until the water starts to rise. Get the details now. For more information about NFIP, visit www.fema.gov, or speak with one of our capable agents, experienced in the options and coverage choices of flood insurance who can help you get the answers you need to create just the right policy for your needs. Whether you live in MD, VA or PA, just contact us today to discuss how we can help.

The scope of your insurance coverage and options depend entirely upon the policy and the insurance company providing it. This website is not intended to advise, offer or bind coverage. You should always discuss your insurance issues with professionals such as a licensed and qualified insurance agent like those here in Timonium, MD at the William M. Sparks Insurance Agency before making any decisions or choosing a course of action.

When your home is a condominium, no matter the building structure, would you know what questions to ask your condo association before purchasing insurance to cover your investment? Condo owners' needs vary. Here at the William M. Sparks Insurance Agency, Inc. in Timonium, Maryland, we can help you understand your options and responsibilities and walk you through making the right choices for your own condo insurance needs whether you are a resident of Maryland (MD), Virginia (VA) or Pennsylvania (PA).

Condominium insurance provides coverage for your personal belongings as well as coverage for structural improvements to your dwelling and additional living expenses if you are forced to temporarily relocate during repair/rebuilding of your unit following a covered disaster.

What is not Covered by your Condo Insurance

Your condo insurance policy will not cover the common areas you share with other condo owners in your building. These typically include the roof, basement, elevator and walkways. These common areas are usually covered by a “master policy” purchased and owned by the condominium association or board.

What to Insure As a Condominium Owner

To ensure that your condo insurance policy offers adequate coverage, first consult your association’s by-laws or proprietary lease, and speak with condo or insurance specialists. Sometimes, a condominium association is responsible for the entire condo unit as originally built, but sometimes only for the bare walls, floors and ceiling. In case of the former, you must only insure alterations to the original structure; but in the latter case, you must insure built-in appliances and casework, wiring, plumbing, kitchen and bath fixtures, etc.

Additional Coverages for your Condo

Coverages in addition to your condominium insurance policy might include:

- Unit assessment to pay your share of an assessment charged to all unit owners by the association for the repair of loss sustained through damage to the common areas.

- Flood or earthquake insurance since these disasters are not typically covered by your condo policy.

- Water back-up coverage pays for loss caused by sewer or drain back-up.

- Additional coverage for expensive belongings such as furs, collectibles, jewelry, etc.

- Catastrophe Liability (Umbrella) coverage to supplement your standard condo insurance policy.

Our capable agents here at the Sparks Insurance Agency in Timonium, MD, have experience with condominium insurance; and with their help, you can learn about available discounts and coverage choices to create just the right policy for your needs if you reside in MD, VA, PA. So why not contact us today to discuss how we can help or get a Condo Insurance quote.

The scope of your insurance coverage and options depend entirely upon the policy and the insurance company providing it. This website is not intended to advise, offer or bind coverage. You should always discuss your insurance issues with professionals such as a licensed and qualified insurance agent like those at the William M. Sparks Insurance Agency, Inc. before making any decisions or choosing a course of action.

Your boat is an important investment – even more important when you add accessories, equipment and a trailer. Here at the William M. Sparks Insurance Agency, Inc. in Timonium, Maryland, we can help you sort through the options and arrive at the best boat insurance coverage for your needs.

The type of boat insurance coverage you require depends upon the size, type and value of your boat and the water in which you use it.

Is Boat Insurance Needed for Small Boats?

Typically, small boats such as small sailboats, canoes and small power boats, may be covered under a renters, condo or homeowners policy.

What Does Boat Insurance Cover?

Larger, faster boats require a separate insurance policy and coverages usually include the following:

- Physical damage or loss – covers permanently attached equipment, machinery, furnishings and fittings as well as the hull. In the event of a physical loss or damage, reimbursement depends upon which of the following types of policies you have chosen.

- Agreed Amount Value – reimburses the previously agreed-upon (full or partial) value of your vessel.

- Actual Cash Value – reimburses replacement cost at the time of the loss, less depreciation.

- Property damage – covers damage to someone else’s property.

- Bodily injury – covers injuries caused to someone else.

- Medical payments – covers injuries to you and/or your passengers.

- Theft of your boat or its covered elements.

- Guest passenger liability – covers legal expenses of someone using the boat with your permission.

Liability limits, deductibles, additional coverages and discounts can vary to meet your needs.

Why not sit down with one of our capable agents who is experienced in boat insurance; and with their help, you can learn about available discounts and coverage choices to create just the right policy for your needs. Just contact us today to discuss how we can help or get a free quote.

The scope of your insurance coverage and options depend entirely upon the policy and the insurance company providing it. This website is not intended to advise, offer or bind coverage. You should always discuss your insurance issues with professionals such as a licensed and qualified insurance agent like those at the William M. Sparks Insurance Agency, Inc. before making any decisions or choosing a course of action.

If you are like most folks, your car is essential to your daily life. You take care of it and take care to avoid damage. But accidents happen, and you need to know you and your car, truck or SUV are protected from loss.

Here at the William M. Sparks Insurance Agency in Timonium, Maryland, we have helped thousands of auto insurance policy holders. Whether you are a resident in Maryland (MD), Virginia (VA) or Pennsylvania (PA), we know the guidelines so we can help you plan your coverage and avoid costly mistakes down the road.

Auto insurance is your protection from the financial loss incurred because of an automobile accident. Your car insurance policy will define exactly how your insurance company will handle your losses when you submit a claim.

Generally, auto insurance includes several types of coverage:

- Bodily injury liability coverage pays for injuries someone else suffers in an auto accident if you are at fault.

- Medical Payments or Personal Injury Protection provides reimbursement for medical treatment suffered by you and/or your passengers during an accident.

- Property damage liability covers damage you caused to someone else’s property.

- Collision coverage pays for damages to your own vehicle in case of an upset or collision with another car or object.

- Comprehensive insurance covers your loss when you experience fire, theft, glass breakage, or damage to your vehicle from something other than collision.

- Uninsured/Underinsured Motorist coverage reimburses for your injuries in case of an accident involving a person without auto insurance, with lower limits that yours which are insufficient to cover your damages, or with a hit-and-run driver.

Liability limits, deductibles, additional coverages and discounts can vary to meet your needs.

Optional Coverages to consider:

- Rental Car Reimbursement

- Emergency Towing

- Loan Security Protection

Add ERIE Auto Plus for a few extra dollars a month and you’ll receive: diminishing deductible, extra days of rental car coverage and increased coverage amounts. Get a lot for a little extra. Contact us today to learn more!

Rates vary by state. Diminishing deductible is up to a maximum reduction of $500. In New York, the comprehensive deductible cannot be reduced to less than $50 and collision deductible cannot be reduced to less than $100. Additional Transportation Expenses are not available in Kentucky. Increased coverage includes higher limits for things like locksmith costs, personal items and non-owned trailers. The endorsement contains the specific details of the coverage, terms, conditions and exclusions. Ask our agency for details. Insurance products are subject to terms, conditions and exclusions not described in this advertisement. Go to erieinsurance.com for company licensure information and product disclosures or contact our agency for state-specific policy information. ERIE® life and annuity products are not available in New York.

So why not take a moment to get a no-obligation review of your current policy or request an auto insurance quote. Our experienced agents are waiting to hear from you.

The scope of your insurance coverage and options depend entirely upon the policy and the insurance company providing it. This website is not intended to advise, offer or bind coverage. You should always discuss your insurance issues with professionals such as a licensed and qualified insurance agent like those at the William M. Sparks Insurance Agency before making any decisions or choosing a course of action.